Benefit in Kind for Cars

When organisations provide a benefit to their employees, HMRC class it as a Benefit in Kind (BiK). Drivers with salary sacrifice cars will need to pay Benefit in Kind, also known as Company Car Tax. When you quote for a car on our website, it’ll include the correct amount of Benefit in Kind. The amount is based on the CO2 emissions, any additional options, fuel types and value. It is also based on your income tax bracket.

For salary sacrifice electric cars, Benefit in Kind is only 3% in 2025/26, rising slowly to reach 9% in 2030. With petrol cars starting at more than 25% Benefit in Kind, there are considerable tax savings when choosing an ultra-low emission car.

Although the idea of Benefit in Kind for salary sacrifice cars might sound confusing, fear not as experts in this area we have prepared a handy guide to help.

In this article we will cover:

- What is Benefit in Kind?

- What is P11D?

- How is Benefit in Kind calculated?

- How is Benefit in Kind shown on my payslip?

- Current Benefit in Kind (Company Car) Tax Rates

- How do I calculate my Benefit in Kind rate?

- Benefit in Kind for Electric Cars

What is Benefit in Kind?

Benefit in Kind applies to any benefits which you receive from your company in addition to your salary. These are sometimes called ‘perks’ and can include anything from private medical insurance that’s paid for by your employer, to childcare vouchers and company cars.

Not all benefits in kind are taxed. For example, subsidised public bus services or bicycles provided to an employee to and from their workplace do not trigger BiK.

As an employee, you need to pay tax on your salary sacrifice car if you or your family use the car privately in any capacity, this includes commuting. This tax is deducted by your employer through Pay As You Earn (PAYE).

What is P11D?

P11D is the taxable value of the car for HMRC purposes. There is a form which employers can use to report expenses and benefits available to employees and the value is included on there each year.

It gives HMRC details of any benefits in kind which are not included in the payroll and subject to PAYE and NIC (National Insurance Contribution) deduction throughout the year.

With this in mind, when we talk about P11D values below, you just need to remember that it means the value of the benefit which you have to pay tax on.

How is Benefit in Kind calculated?

Unless you use your salary sacrifice car solely for business purposes, not including commuting, it is classed as a Benefit in Kind and therefore you need to pay tax on it.

How much tax you pay is dependent on the following:

How is Benefit in Kind shown on my payslip?

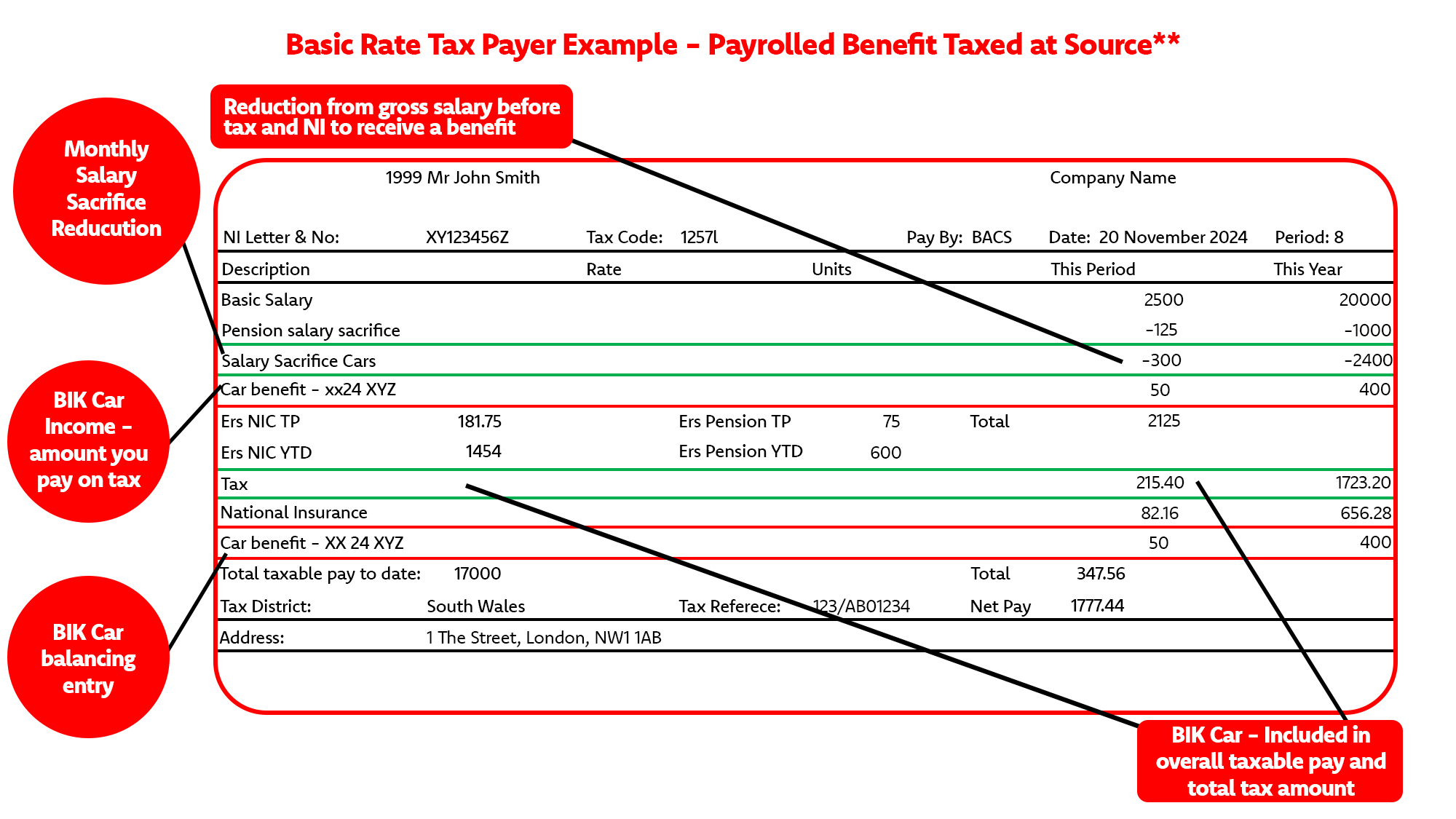

We’ve included examples of payslips to show the gross amount shown for the car scheme and the actual net deduction from salary. When you ordered your car with Tusker, you would have been shown a gross and net deduction with the net being the actual reduction in your pay i.e. How much the car is going to cost you each month. It’s done like this due to the rules about deductions from HMRC.

The payslip examples below highlight the gross deductions made through the scheme. This is the amount taken from the employee’s salary before Income Tax and National Insurance have been deducted (they’re shown in the same column). Income Tax and National Insurance are applied to the new salary amount without the amount for the car included. The net change to the employee’s salary is highlighted on the right, which is the figure they would have agreed for their car when they ordered with Tusker.*

*These figures have been calculated based on the current BiK rates, NI and Tax thresholds as of 1st December 2024

** The mock payslips are based on the pension scheme and contributions being operated as salary sacrifice

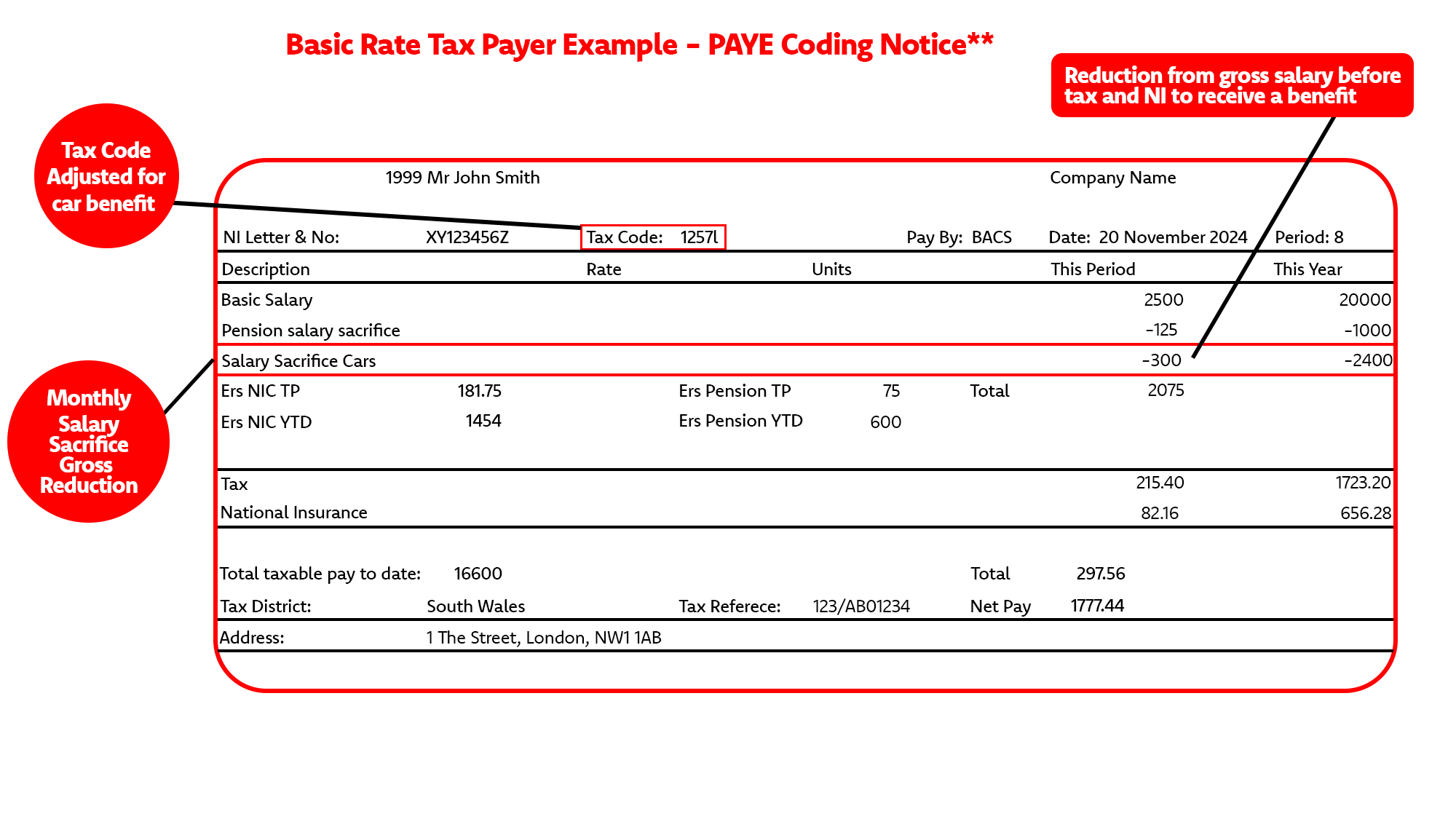

There are two ways of managing payroll for benefits. The one below shows the alternative to payrolling benefits which is to change the employee’s tax code which shows differing information to the first example shown.*

*These figures have been calculated based on the current BiK rates, NI and Tax thresholds as of 1st December 2024

** The mock payslips are based on the pension scheme and contributions being operated as salary sacrifice

Benefit in Kind (Company Car) Tax Rates 2022-2030

Please see below for tax tables up to April 2030*. For 2025/26, the company car tax rates on EVs will be 3%, slowly rising per year to 9% by 2030. The company car tax rates for ultra-low emission cars (non EVs) emitting less than 75g/km will also slowly increase from April 2025, rising to a maximum of 23%.

| CO2 | Electric Range | 2022/25 | 2025/26 | 2026/27 | 2027/28 | 2028/29 | 2029/30 |

|---|---|---|---|---|---|---|---|

| % | % | % | % | % | % | ||

| 0 | 2 | 3 | 4 | 5 | 7 | 9 | |

| 1-50 | >130 | 2 | 3 | 4 | 5 | 18** | 19 |

| 1-50 | 70-129 | 5 | 6 | 7 | 8 | 18 | 19 |

| 1-50 | 40-69 | 8 | 9 | 10 | 11 | 18 | 19 |

| 1-50 | 30-39 | 12 | 13 | 14 | 15 | 18 | 19 |

| 1-50 | <30 | 14 | 15 | 16 | 17 | 18 | 19 |

| 51-54 | 15 | 16 | 17 | 18 | 19 | 20 | |

| 55-59 | 16 | 17 | 18 | 19 | 20 | 21 | |

| 60-64 | 17 | 18 | 19 | 20 | 21 | 22 | |

| 65-69 | 18 | 19 | 20 | 21 | 22 | 23 | |

| 70-74 | 19 | 20 | 21 | 21 | 22 | 23 | |

| 75-79 | 20 | 21 | 21 | 21 | 22 | 23 | |

| 80-84 | 21 | 22 | 22 | 22 | 23 | 24 | |

| 85-89 | 22 | 23 | 23 | 23 | 24 | 25 | |

| 90-94 | 23 | 24 | 24 | 24 | 25 | 26 | |

| 95-99 | 24 | 25 | 25 | 25 | 26 | 27 | |

| 100-104 | 25 | 26 | 26 | 26 | 27 | 28 | |

| 105-109 | 26 | 27 | 27 | 27 | 28 | 29 | |

| 110-114 | 27 | 28 | 28 | 28 | 29 | 30 | |

| 115-119 | 28 | 29 | 29 | 29 | 30 | 31 | |

| 120-124 | 29 | 30 | 30 | 30 | 31 | 32 | |

| 125-129 | 30 | 31 | 31 | 31 | 32 | 33 | |

| 130-134 | 31 | 32 | 32 | 32 | 33 | 34 | |

| 135-139 | 32 | 33 | 33 | 33 | 34 | 35 | |

| 140-144 | 33 | 34 | 34 | 34 | 35 | 36 | |

| 145-149 | 34 | 35 | 35 | 35 | 36 | 37 | |

| 150-154 | 35 | 36 | 36 | 36 | 37 | 38 | |

| 155-159 | 36 | 37 | 37 | 37 | 38 | 39 | |

| 160+ | 37 | 37 | 37 | 37 | 38 | 39 |

*Add 4% for diesels up to a maximum of 37% (unless RDE2 compliant). Diesel plug-in hybrids are classed as alternative fuel vehicles, so the 4% diesel supplement does not apply to these vehicles irrespective of RDE2 compliance.

** Please be aware that from 2028/29 BiK rates for Hybrid Vehicles see an uplift from 5% to 18%.

How do I calculate my Benefit in Kind rate?

For cars with more than 75g/Km CO2, the taxable benefit is calculated based on the higher value of either the gross salary sacrifice amount or the Benefit in Kind value.

For low emission cars (those with less than 75g/Km CO2), there are three main steps to calculating your BiK:

Benefit in Kind for Electric Cars

With BiK rates fixed until 2030, you can maximise your savings when choosing an electric or plug-in hybrid vehicle. To understand the savings, here is a price comparison of hybrid, electric and diesel options of the same car.

Let’s meet Anne. Earning £40,000 a year as a company administrator, Anne is 41 years old, lives in Chelmsford with her husband and two young children. She wants a roomy, reliable car for short journeys (taking the kids to after school activities, a weekly supermarket shop and visits to friends in the local area). The Kia Niro is an ideal choice for Anne but, on the basis of driving 5,000 miles a year, how much can she save by switching to electric?

Download our Benefit in Kind Guide

Car salary sacrifice remains a great company benefit that can put extra cash back in your pocket while giving you a brand new car. We’ll always have the most up-to-date information for you here, based on the latest Government guidance.

If you would like to find out more about Benefit in Kind, how to pay it and what affects you, please download your Benefit in Kind Guide.

Download Now